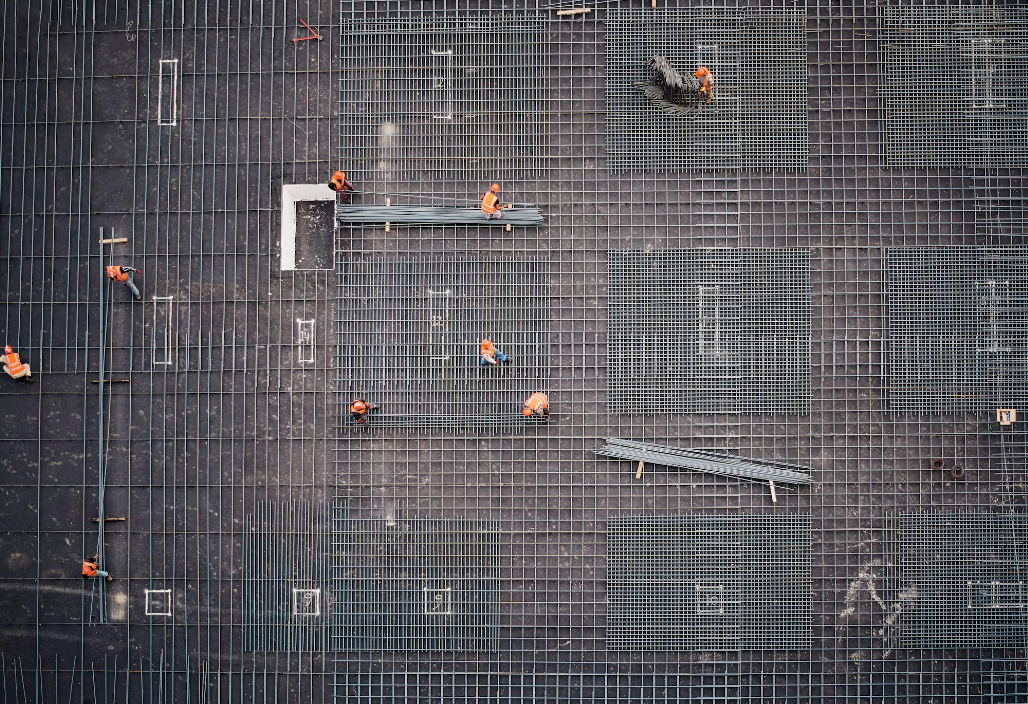

U.S. Construction: The Industry Disruptors of 2024

By KERRY SMITH

What are the 3 most impactful disruptors of the construction industry in 2024?

The short list may look familiar: a deficit of workers, a surplus of federal construction grant programs and emerging technologies.

During a Feb. 13 Engineering News-Record industry panel event, Deloitte Senior Manager of Transactions and Business Analytics Mohinder Singh identified these three industry disruptors as the largest, most palpable ones faced by anyone who touches a construction project.

The top 3 – a skilled and unskilled construction worker shortage, a plethora of public infrastructure grant dollars and an even greater plethora of data-centric technologies, apps and more are squeezing a low-staffed core of people responsible for submitting, winning and delivering projects of all kinds on time and within budget.

“The large disruption in the construction workforce itself – brought on for years now from the Covid pandemic, retirements and a lack of effective/sufficient industry recruting of young people continues to manifest,” Singh says. “I believe that a lack of focus (early on) of STEM (science, technology, engineering and mathematics) is partly to blame for the lower intake of students and young professionals entering the industry.”

If the construction industry hopes to succeed in attracting the volume of Gen Z’ers (those born in 1997-2012), employers must offer a work environment and organization that already knows how to embrace, harness and utilize data technologies. Gen Z’s are not attracted to firms requiring a manual review of spreadsheets and on-site inspections of every job location.

“This generation craves technological processes and solutions, and will gravitate to construction industry companies who offer it,” he says.

While the anticipated burst of available funding for public infrastructure work was anticipated due to November passage of the Infrastructure Investment and Jobs Act, the constraints of a still-unpredictable material supply chain and the Build America Buy America requirement (that all domestic content procurment of iron, steel, manufactured products and construction materials used in public infrastructure jobs be U.S. made) are also industry disruptors.

Singh says the third major industry disruptor this year is the rapid digital transformation. The construction industry, he says, is pressed – in a competitive sense – to learn and adopt emerging technologies as project owners’ and project partners’ tech savviness and expectation threshholds are increasing.

“My advice to owners and constructors is to start getting ready for these digital transformations by looking at their organizations and deciding where efficiencies and process improvements can be made” says Singh. “Start looking intently at your infrastructure systems architecture – all the tech platforms you’re currently using to feed project delivery – and identify any redundancies.”

Singh says one of Deloitte’s clients has 26 separate and disctinct tech systems that are all feeding the organization. “We ask our clients if some of their systems might be able to be rolled into an enterprise system, a large, complex computing system that handles large amounts of data. From the owner’s perspective, the single biggest issue is the integrity of the data. How do they improve data integrity so they can have more confidence in it? Start analyzing your data landscape and data governance,” he adds.

Fresh Content

Direct to Your Inbox

YOUR RESPECTED INDUSTRY VOICE

Join CNR Magazine today as a Content Partner

As a CNR Content Partner, CNR Magazine promises to support you as you build, design and engineer projects not only in and around St. Louis, but also across the U.S. CNR is equipped and ready to deliver a dynamic digital experience paired with the top-notch, robust print coverage for which you’ve always known and respected the magazine.